Understanding Exness Maximum Withdrawal Limits

When exploring the financial landscape of online trading, one key factor that every trader considers is the withdrawal limits imposed by their broker. This is particularly true for platforms like Exness, which have gained prominence for their user-friendly interface and extensive range of trading options. If you’re interested in trading with Exness, understanding the exness maximum withdrawal Exness Paraguay limits is essential for planning your trading strategy effectively.

What is Exness?

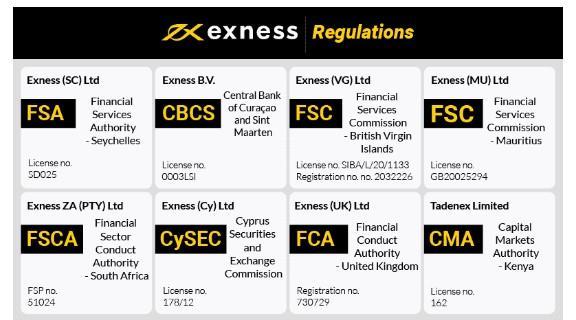

Exness is a worldwide brokerage firm that operates under several regulatory bodies, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). Founded in 2008, Exness has continually expanded its services to cater to diverse markets, ensuring that traders have access to a range of financial instruments, including forex, cryptocurrencies, commodities, and indices. One of the standout features of Exness is its competitive trading conditions, which include low spreads and high leverage, making it an attractive choice for both novice and experienced traders.

Withdrawal Limits: An Overview

The maximum withdrawal amount a trader can execute on Exness varies based on several factors, including the account type, the payment method, and regulatory requirements. Understanding these limits is crucial, as they can significantly impact your trading capital and profit-taking strategies.

Account Types and Their Withdrawal Limits

Exness offers several account types, each with its own set of features and benefits. The primary account types include:

- Standard Account: Ideal for new traders, this account allows for easy withdrawals with a maximum limit that can reach up to $2,000 per day.

- Pro Account: Aimed at experienced traders, this account type offers higher leverage and larger withdrawal limits that can exceed $10,000 per day.

- Cent Account: Designed for beginners, typically features lower limits around $1,000, but offers a comfortable learning environment.

The type of account you choose can greatly influence how much you can withdraw at once, making it important to select the one that aligns with your trading goals and financial needs.

Payment Methods Impacting Withdrawal Limits

Additionally, the method chosen for withdrawals also plays a crucial role in determining the maximum withdrawal limits. Exness supports a variety of payment methods, including:

- Bank Transfers: Generally associated with higher withdrawal limits, but may take longer to process.

- Credit/Debit Cards: Often feature a maximum withdrawal limit of $2000 per transaction, depending on the issuing bank.

- Online Payment Systems: Platforms like Skrill and Neteller may permit higher limits and faster transactions, making them popular choices among traders.

Each method has its own pros and cons, and understanding these is essential for optimizing your withdrawal strategy.

Regulatory Considerations

Being a regulated broker, Exness adheres to various financial regulations, which influence withdrawal limits. For instance, the broker conducts stringent verification procedures to prevent fraud and money laundering. As such, traders must complete the verification process before they can access higher withdrawal limits. This includes providing identification and proof of address, which ensures that all funds are being managed responsibly and legally.

Tips for Managing Withdrawals Effectively

To effectively manage your withdrawals on Exness, consider the following tips:

- Choose the Right Account Type: Select an account type that aligns with your trading strategy and anticipated withdrawal frequency.

- Utilize Preferred Payment Methods: Opt for payment methods that offer higher limits to ensure faster and more efficient access to your funds.

- Plan Your Withdrawals: If you know you’ll need to withdraw a large sum of money, plan your trading and withdrawal activities accordingly to avoid delays.

- Stay Informed: Regularly review Exness’s policies, as withdrawal limits may change based on regulatory updates or new financial products offered by the broker.

Conclusion

In summary, understanding the Exness maximum withdrawal limits is crucial for every trader. It not only impacts how you manage your funds but also how you can leverage your trading strategy based on your financial goals. By taking into account the account type, payment methods, and regulatory considerations, you can optimize your trading experience and ensure that your profits are accessible when needed. Always take the time to review the latest policies offered by Exness to stay updated on any changes that could affect your withdrawals.